Real Estate Pulse: Recapping 5 years!

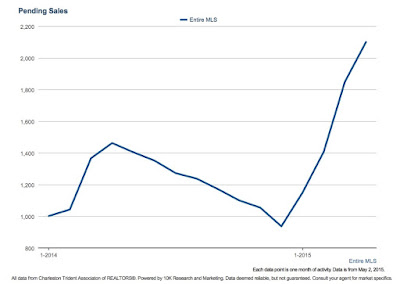

Real Estate Pulse: Recapping 5 years! Active Housing Market keeps persuading buyers and now sellers The last 5 years of the real estate market has been a wild ride to say the least. In 2010, first time home buyers increased dramatically over the norm due to the large tax credit given out by the federal government. That triggered the highest number of first time buyers ever. While this group accounted for half of the homes purchased in 2010, the other key players were the international (cash) investors who were purchasing the rock-bottom-priced inventory. This same group of investors and first time home buyers were the main consumers of real estate through 2012. By this time, the excess inventory had been purchased one way or another. In 2013, values of homes were finally catching up and or exceeding the mortgage pay off(s). Finally sellers and their listings began trickling into the market. This segment of the housing market was previously stagnant and was on the sid